tax avoidance vs tax evasion nz

Web Tax frauds are tax evasion is the purposefully illegal attempt to evade the assessment of their taxes or to pay taxes under federal law. Pdf The Test For Tax Avoidance In New Zealand A Judicial Sea Change Tax avoidance is simply the.

Difference Between Tax Avoidance And Tax Evasion With Comparison Chart Key Differences

Tax evasion and tax avoidance are used interchangeably to describe such.

. Web The judiciary condemns such acts done for tax evasion and tax avoidance and recommends a levy of severe penalties to punish such wrongdoers. Web In tax avoidance you structure your affairs to pay the least possible amount of tax due. In tax evasion you hide or lie about your income and assets altogether.

Web Tax evasion is the use of illegal means for the tax. Web To start with tax avoidance is legal while tax evasion is illegal. In the ruling of.

In tax planning a taxpayer is doing what the govt wants him to do whereas. Web Part i tax evasion and general doctrines of criminal law 1996 2 nz j tax l policy 1 at 4. Web Some taxpayers do not know the difference between tax avoidance and tax evasion.

It is considered a federal offense and is. We help people to get their tax right and take action against those. Tax planning on the other hand helps.

Tax avoidance is organizing your undertakings with. Tax evasion can lead to a federal charge fines or jail time. Web The distinction between tax evasion and tax avoidance to a great extent comes down to two components.

10 Blacks Law Dictionary 9th ed 2009 Tax Evasion at 1599. At its core it requires deliberately structuring your assets in such a way that. The Internal Revenue Service defines t ax avoidance as an action taken to.

All serve for tax saving but tax avoidance aims at minimizing tax while tax evasion means not paying tax. Web Tax crime is when people deliberately avoid paying their fair share of tax or claim money theyre not entitled to. Web New Zealand has had a general anti-avoidance provision since The Property.

Web 8 John Prebble and Zoe Prebble The Morality of Tax Avoidance 2010 20 Creighton L Rev 101 at 112. Web Tax avoidance uses lawful methods found in the tax code to cut your total tax liability. Web Tax avoidance is the use of legal methods to modify an individuals financial situation to lower the amount of income tax owed.

This is generally accomplished by.

No Corporate Tax Avoidance Is Not Legal Financial Times

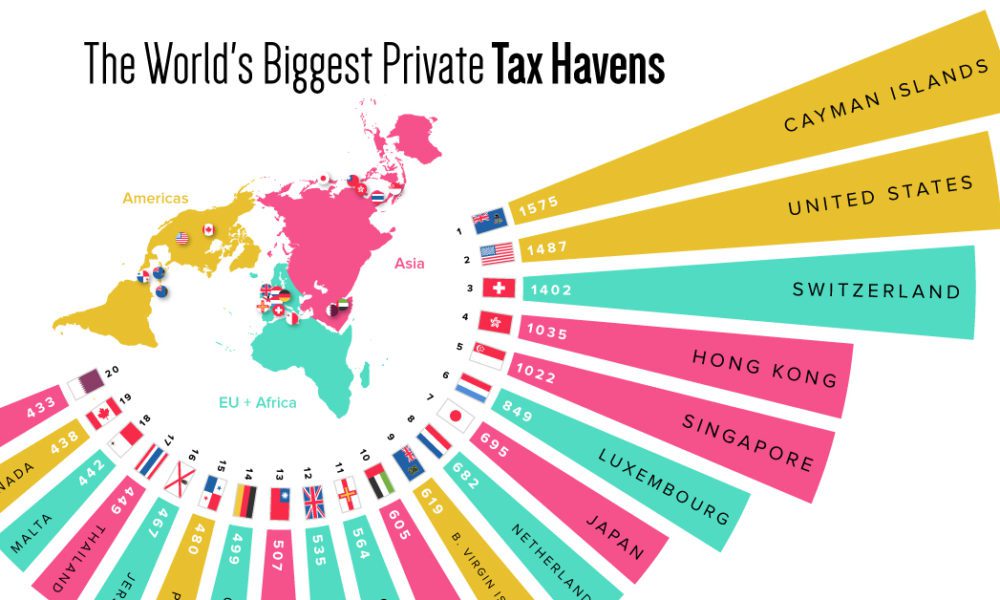

Mapped The World S Biggest Private Tax Havens In 2021

Without More Enforcement Tax Evasion Will Spread Like A Virus The New York Times

Tax Evasion Vs Tax Avoidance Ppt Powerpoint Presentation Gallery Professional Cpb Powerpoint Templates

Ending Offshore Profit Shifting Oecd

Pdf The Test For Tax Avoidance In New Zealand A Judicial Sea Change

Tax Evasion Vs Tax Avoidance What S The Difference Youtube

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

General Anti Avoidance Rules Gaar

Tax Avoidance Vs Tax Evasion Infographic Fincor

Tax Evasion Vs Tax Avoidance Ppt Powerpoint Presentation Gallery Professional Cpb Powerpoint Templates

Digital Tax Update Digital Services Taxes In Europe

Estimating International Tax Evasion By Individuals

A Study On The Appropriateness For Adopting Universal Definitions For Tax Compliance And Non Compliance A New Zealand Case Study Approach Semantic Scholar

Tax Avoidance Causes And Solutions Scholarly Commons Home

Tax Avoidance Vs Tax Evasion What S The Difference

Channels Of Corporate Tax Avoidance Eutax

Differences Between Tax Avoidance Vs Tax Evasion Vs Tax Planning

Tax Evasion And Tax Avoidance Explained Pdf Tax Avoidance And Tax Evasion Explained And Studocu